Canada T2057 2017-2024 free printable template

Show details

You can file Form T2057 within three years after its due date if you pay an estimate of the penalty at the time of filing. N is the sum of each month or each part of a month in the period from the filing due date to the actual date filed. T2057 E 17 Ce formulaire est disponible en fran ais. Amount enclosed Make your cheque or money order payable to the Receiver General. On the back write T2057 the transferor s name and their social insurance trust account or business number. You can also...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your t2057 2017-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t2057 2017-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t2057 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t2057 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Canada T2057 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t2057 2017-2024 form

How to fill out t2057

01

To fill out the T2057 form, follow these steps:

02

Start by entering your personal information, including your name, address, and social insurance number.

03

Next, provide details about the property or land you are transferring, including the address and legal description.

04

Indicate the type of transfer you are making, whether it is a gift, sale, or other type of transfer.

05

If applicable, provide information about any mortgage or lien on the property being transferred.

06

Complete the section on fair market value, providing the estimated value of the property being transferred.

07

If the transfer involves a partnership or corporation, provide details about the business entity.

08

Finally, sign and date the form, and provide any additional supporting documentation as required.

09

Note: It is recommended to consult with a tax professional or refer to the official form instructions for specific guidance on filling out the T2057 form.

Who needs t2057?

01

The T2057 form is needed by individuals or entities who are transferring property or land under certain conditions. This form is typically used for tax purposes and is required by the Canada Revenue Agency (CRA). Individuals or entities who are gifting, selling, or otherwise transferring property may need to fill out and submit this form to declare the transfer and fulfill their tax obligations.

Video instructions and help with filling out and completing t2057

Instructions and Help about t 2057 form

Fill form t2057 pdf : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

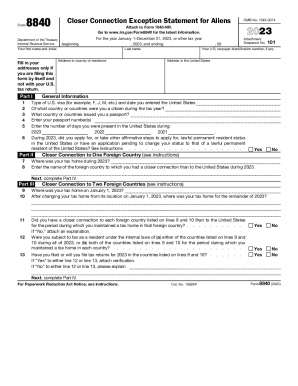

What is t2057?

T2057 is not a specific term or concept that can be identified. It is possible that it refers to a specific form or document used in a particular context, but without further information, it is difficult to determine its exact meaning. Please provide more context or details for a more specific answer.

Who is required to file t2057?

The T2057 is a form that is required to be filed by individuals who are not residents of Canada for tax purposes but have income from Canadian sources. This includes non-resident individuals who receive rental income from Canadian real estate, pension income from Canadian sources, or income from a business carried on in Canada.

How to fill out t2057?

Form T2057 is used by individuals to report disposition of property by a taxpayer not resident in Canada. It is typically used when a non-resident of Canada sells or disposes of Canadian real estate or Canadian resource properties. Here are the general steps to fill out Form T2057:

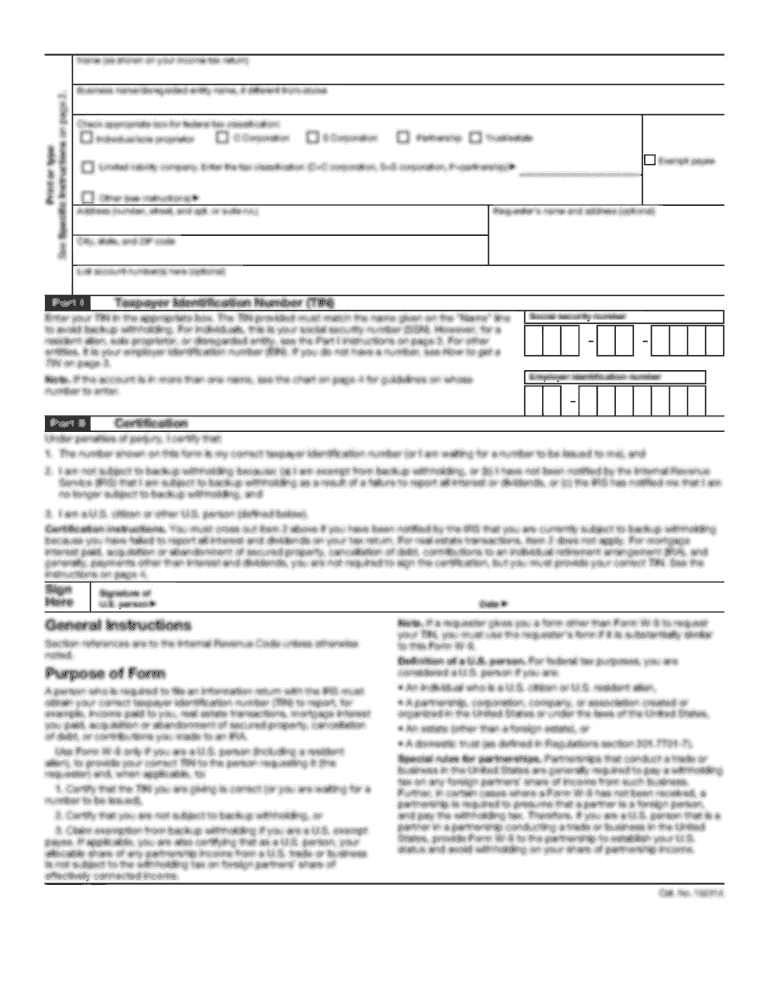

1. Personal Information: Enter your personal information, including your name, address, social insurance number (SIN), and the tax year for which the form is being completed.

2. Disposition Details: Provide details about the transaction, such as the date of disposition, the type of property being disposed of (real estate, resource property, etc.), and a description of the property.

3. Proceeds of Disposition: Enter the total proceeds received from the disposition of the property in Canadian dollars. If the proceeds were received in a foreign currency, you will need to convert it to Canadian dollars using the Bank of Canada exchange rates.

4. Adjusted Cost Base (ACB): Calculate the ACB of the property, which is the original cost of acquiring the property adjusted for any capital improvements or expenses incurred. Enter the ACB amount in Canadian dollars.

5. Gain or Loss: Calculate the gain or loss on the disposition by subtracting the ACB from the proceeds of disposition. If there is a gain, it is generally subject to Canadian tax. If there is a loss, it may be deductible against other capital gains.

6. Tax Treaty: Indicate if you are eligible for any tax treaty benefits or relief by checking the appropriate box and provide any additional information required.

7. Declaration and Signature: Review the information provided, sign and date the form, an authorize the representative if applicable.

Remember to keep a copy of the completed form for your records, as well as any supporting documentation relating to the disposition of the property. It is always recommended to consult with a tax professional or seek guidance from the Canada Revenue Agency (CRA) for specific questions related to your tax situation.

What is the purpose of t2057?

T2057 is not a standard or commonly referred form, so it is difficult to determine its specific purpose without more context. It is possible that T2057 refers to a specific form used in a particular country or industry, in which case its purpose would be specific to that context. If you can provide additional information or clarify the context of T2057, I can try to provide a more accurate answer.

What information must be reported on t2057?

The T2057 form is used to report the disposition of property by a taxpayer. The following information must be reported on the T2057 form:

1. Taxpayer Information: The full name, address, and social insurance number (SIN) or business number (BN) of the taxpayer must be provided.

2. Property Information: Details about the property being disposed of, such as the description, address, and legal description.

3. Disposition Information: The date of disposition and the selling price of the property must be reported. If there were any expenses related to the disposition, these should be included as well.

4. Calculation of Gain/Loss: The proceeds of disposition (selling price) and the adjusted cost base (ACB) of the property must be provided. The difference between these two values will determine the gain or loss on the disposition.

5. Principal Residence Designation: If the property being disposed of was a principal residence, the taxpayer must indicate this on the form. This determination can have implications on the taxation of the gain from the disposition.

6. Capital Gains Exemption: If eligible, the taxpayer should report any capital gains exemption being claimed on the disposition. This may include exemptions like the Principal Residence Exemption or the Lifetime Capital Gains Exemption.

7. Other Information: Any additional relevant information or explanations related to the disposition can be provided in the designated space on the form.

It is important to note that the T2057 form is used for reporting the disposition of property for individuals or partnerships. Different forms may be required for corporations or other entities. It is recommended to consult with a tax professional or the Canadian Revenue Agency (CRA) for specific guidance on completing the T2057 form.

What is the penalty for the late filing of t2057?

The penalty for the late filing of Form T2057 (Election for a Capital Gains Reserve) is typically the greater of $8,000 or 10% of the total amount of the capital gain that is allowed to be claimed as a reserve. It's important to note that this penalty is subject to certain conditions and exceptions outlined by the Canada Revenue Agency (CRA). It is recommended to consult with a tax professional or refer to the CRA guidelines for specific details and circumstances.

How can I modify t2057 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including t2057 form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit how to t2057 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your t 2057, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit form t2057 form on an iOS device?

Create, modify, and share t2057 canada form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your t2057 2017-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To t2057 is not the form you're looking for?Search for another form here.

Keywords relevant to how to t2057 form

Related to t 2057 t2057

If you believe that this page should be taken down, please follow our DMCA take down process

here

.